No Insurance Policy? What Happens After An At-fault Crash

This additional insurance coverage may certainly consider possible negotiation conversations with the insurance company-- if you understand the accused has it. However since the courts also do not desire everybody to go "claim crazy," the procedure can be long and arduous, and we do not advise trying it without a seasoned car mishap lawyer. That's why, in circumstances like these, your lawyer can take legal action against the other chauffeur and pursue "recreational properties," like large savings accounts, added automobiles, expensive boats, or vacation homes.

What Are The Legal Charges For Driving Without Insurance?

Drivers without insurance coverage may also obtain fined and have their autos taken away. If there are various other assets that are less complicated to sell, like trucks, autos, or watercrafts, after that the regional sheriff can implement the judgment and take those properties. The sheriff is entitled to a percent of what is made on the sale of those properties.

Auto mishaps can be very complicated situations, and I urge you to speak to an experienced personal injury lawyer when identifying your course of action. The depressing fact is that, most of the times, chauffeurs who have no insurance coverage or are underinsured are uncollectable. This implies that even if you achieve success in your claim, if the accused has no important possessions or no money, Visit this website you are entrusted to a judgment that is unenforceable.

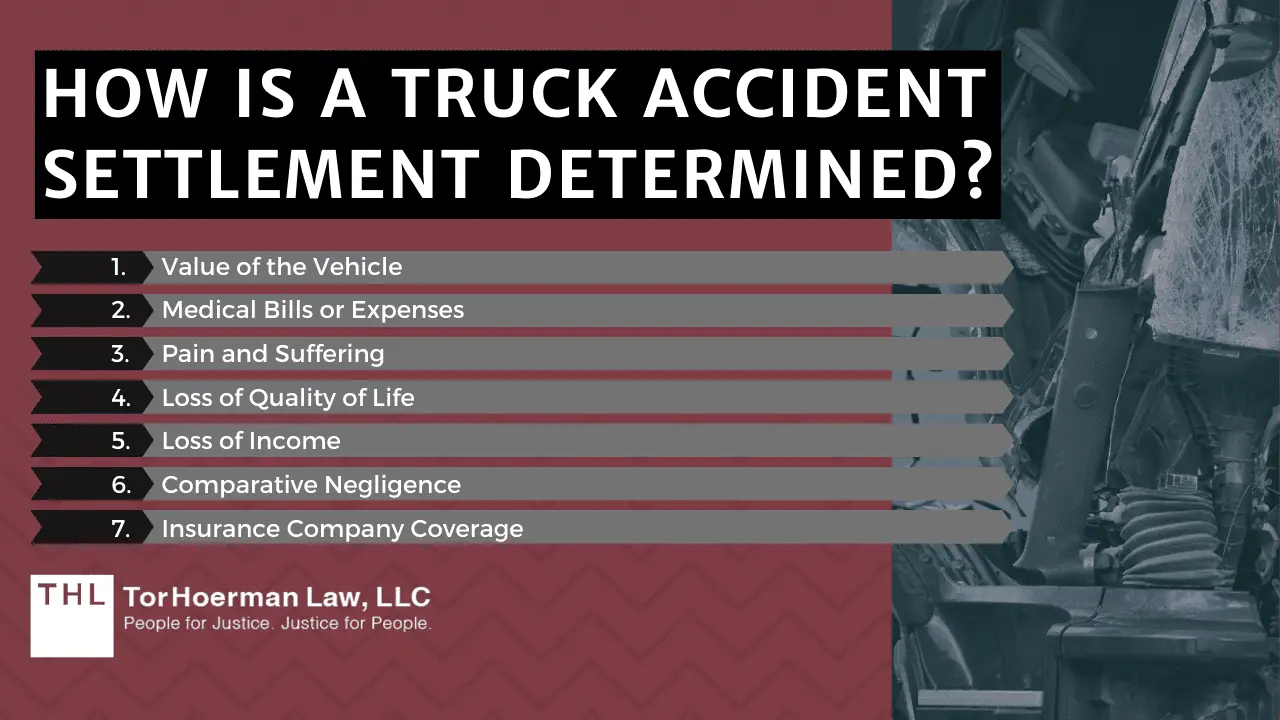

How Usually Do Car Crash Negotiations Exceed The Insurance Policy Limitations?

Mishap reports need to be made by drivers or law enforcement when an auto accident takes place in Texas. Title 7, Phase 550 clarifies the policies for coverage, which should happen when a mishap hurts or eliminates somebody or causes at the very least $1,000 in building damage. According to Texas Code Section 16.003, collision targets have two years from the day of the mishap to make an accident insurance claim and seek compensation from the at-fault driver. Once that two-year time period has actually passed, the case will certainly be time-barred since the statute of limitations will certainly have gone out. In a lot of cases, one vehicle driver clearly made a mistake that resulted in an accident.

Browsing The After-effects Of A Crash With An Uninsured Vehicle Driver

- In such cases, you can either accumulate from your very own insurance firm if you have an underinsured policy, or sue the at-fault motorist.In many cases, an attorney might also examine various other prospective sources of settlement.Texas has regulations in position controling what happens after motor vehicle mishaps, and it's important that all motorists recognize these policies and laws.The specifics of what's covered will depend upon your policy information and the laws in your state.

All of this information could be extremely vital when victims intend to go after an automobile accident case to recuperate payment for their losses. Insurer are leveraging mobile apps to enhance the claims procedure and enhance client service. Through these apps, vehicle drivers can instantly report mishaps, upload photos of damages, and even start insurance claims. While insurance coverage can cover several expenditures, having added financial savings can aid cover deductibles and various other out-of-pocket costs right away adhering to a mishap with an uninsured vehicle driver.

Likewise, if the crash took place on improperly kept residential property, a premises responsibility insurance claim might be feasible. An authorities record offers an official record of the event and can be invaluable when suing with your insurance company. The police can likewise assist facilitate the exchange of information if the other driver is uncooperative. This choice ensures you don't have to pay out-of-pocket for the problems. A without insurance chauffeur harmed in an accident triggered by an additional celebration might still look for payment. The at-fault motorist's responsibility insurance coverage must cover medical expenses, lorry repairs, and other losses, but settlement depends upon plan limitations. If problems exceed these limitations, added lawsuit might be needed.